Admit it, you know it is way too early to form definitive conclusions about how Hard Seltzers and other BEYOND BEER styles will perform on draft in 2020, but that doesn’t stop any of us from wanting to know how they are getting out of the gate.

BeerBoard and our Data Insights team compiled the first of an ongoing report on the performance of Hard Seltzers and Beyond Beer styles.

Here it is. Just for you.

Hard Seltzer Draft Report: The Way Too Early Edition

About this Report

The rise of Hard Seltzers / Beyond Beer

- Draft Hard Seltzers began populating BeerBoard’s real-time, on premise insights in May 2019 with limited brands/taps. They have now grown to double digit brands & triple digits taps.

- The opportunity for Hard Seltzer/Beyond Beer styles was clear with the number of underperforming craft handles at many bars/restaurants nationwide.

Report Overview

- BeerBoard is the leader in real-time data, insights and consumer engagement for on-premise retailers and brewers. We manage over $1 billion in draft beer sales annually and 45,000 products through our proprietary data and insights platform and work with the largest retailers and brewers to help them sell more beer and make more money.

- After starting with a few brands on tap, we are now armed with some WAY TOO EARLY insights generated from our proprietary data and insights

- Styles losing the most handles to Hard Seltzer?

- Is Hard Seltzer cannibalizing other brands from their own brewery, or helping to gain tap share?

Tap Insights

Tap Distribution Growth

-

In July to August, growth of tap count growth was 400%

-

August to September increased another 100%, projecting to to continue the strong month-over-month growth.

Brewery Insights

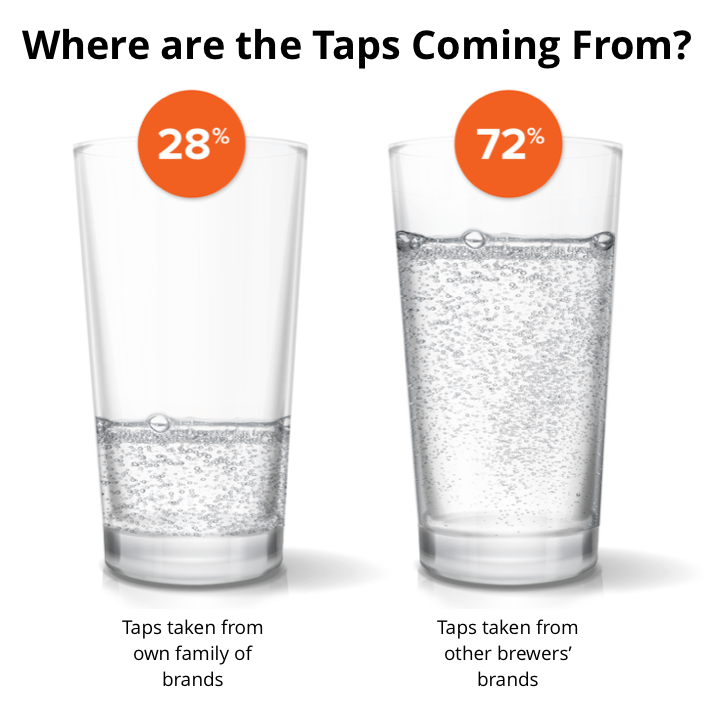

Are Hard Seltzer taps cannibalizing the brewery’s other brands for real estate or are they taking taps from breweries’ brands?

- 28% of Hard Seltzer taps are taken from their own family of brands

- 72% of Hard Seltzer taps are taken from other brewers’ brands

Style Insights

-

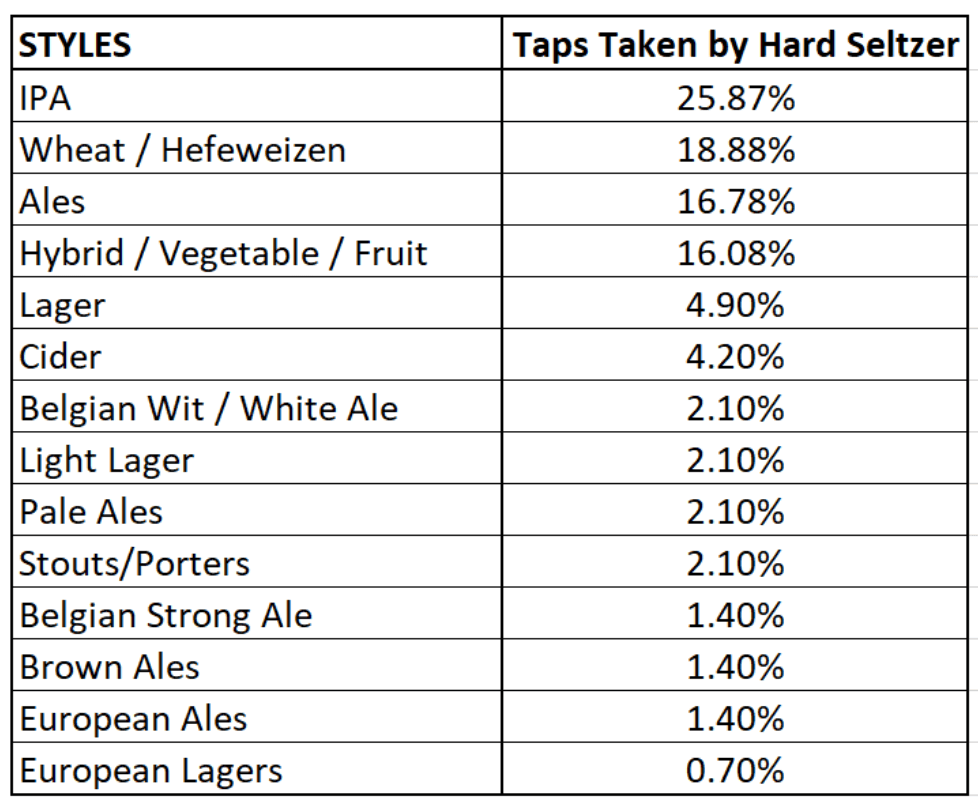

What is your guess on which Style where the Hard Seltzers are taking the most taps from?

-

Yeah that was too easy – IPAs. 1 out of every 4 Hard Seltzer tap gained was taken from an IPA.

Velocity Insights

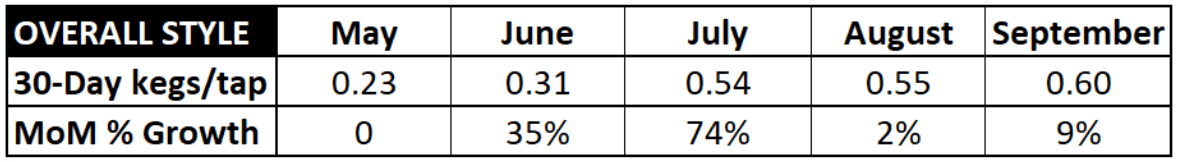

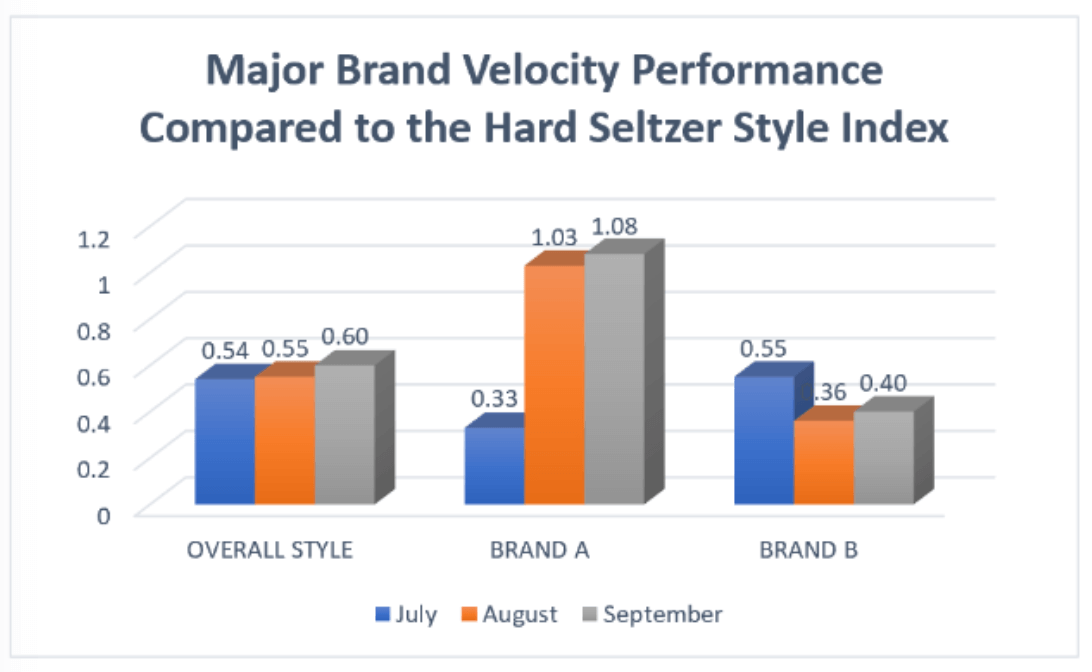

Velocity is measured by the equivalent number of 1,984 ounce kegs poured by tap per 30-days (30-Day kegs/tap).

Index Performance

-

Retailers & breweries have yet to implement any large scale Hard Seltzer Draft education/promotional programs, thus velocities as expected are not setting records.

-

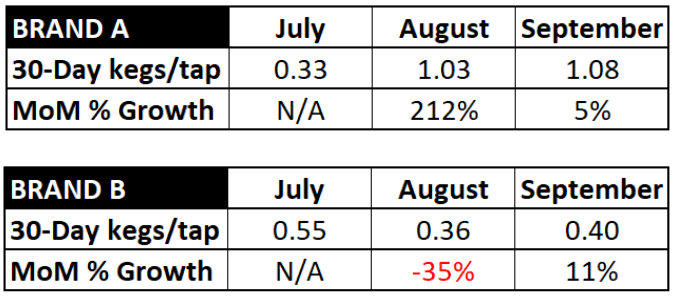

Brand performance is all over the map but here is a sneak peek at how two major brands have performed over the trailing 3-months (brand names shown to Data Insights partners).

Conclusions: Way Too Early

The Opportunity

- With more brands and placements being added to the tap set mix, Hard Seltzers will be getting the opportunity to prove their value beyond cans.

- This is especially the case in bars and restaurants wanting to address over-indexed styles (IPAs) and underperforming handles.

- Without any substantial targeted retailer/brewery staff education & consumer promotion regarding availability & how to enjoy the draft offerings, the hard seltzer style 30-Day kegs/tap velocity has nearly tripled from .23 to .60 kegs, some brands have already jumped out front.

What Comes Next

- With Summer closed out and the consumer trend headed toward heavier options, let’s see where this style is headed and if we see some seasonality in play as we go forward.